Last Update – 31st May 2021

What is eCommerce website?

Ever wonder what are the best payment gateways in Sri Lanka available to integrate with your eCommerce website? Finalising a payment gateway for your business is always challenging. Without the growing trend in eCommerce in Sri Lanka, the need for the proper payment gateway is also increased. There are several eCommerce website developer Sri Lanka available, however, how many developers suggest the best payment gateways to you?

An eCommerce website, by explanation, is a website that permits you to sell and buy tangible products, digital products or services on the internet. E-Commerce is also known as e-Business, or electronic business is just the buy and sells of facilities and goods over an electric medium such as the Internet. It also includes electronically transferring funds and data between two or more parties.

What is a payment gateway? how does a payment gateway work?

A payment gateway is a technology used by traders to receive debit or credit card procurements from clients. The term comprises not only the physical credit/debit card reading machines found in retail stores but also the payment processing gateways found in online eCommerce websites.

A payment gateway is an online connection that marks the entire process of online payment more efficient and safer. Its actions as a safer link between your eCommerce website or app and the bank.

1. The part of payment gateway commences when a client decides to procurement on your eCommerce store.

2. Your eCommerce website or app that you have incorporated with the payment gateway directs the payment information (Debit. Credit card details or Netbanking details) of the client to the payment gateway.

3. The payment gateway then validates and authorises the payment info with the bank.

4. Upon positive confirmation, the amount is discharged from the customer’s bank account and is moved into your bank account.

Thus, the payment gateway actions as an intermediate that confirms simple and secure online cash transactions.

What do you need to study before finalising a payment gateway for your eCommerce website?

Before you decide the best payment gateways in Sri Lanka for your eCommerce website or your online store, you have to focus on a few significant factors. They are,

- General payment gateway fee comprising setup fee, annual fee, and Transaction Discount rate (TDR).

- Settlement period (The period taken by the payment gateway to credit the due amount to your bank account.)

- User Interface or Dashboard of the payment gateway.

- Compatibility of the Mobile App or Mobile Version

- Payment options such as Credit/Debit cards, mobile wallets, monthly instalment, etc.

- After Sale and Customer Service by the vendor

Numerous payment gateways in Sri Lanka allow clienteles to make payments online. Here are the top payment gateways in Sri Lanka in 2020.

Top payment gateways in Sri Lanka in 2021

1. Sampath Bank Payment Gateway

Sampath Bank is the primary IPG provider to offer a payment gateway to accept Sri Lankan Rupee (LKR) on the internet.

Currently, Sampath Bank Internet Payment gateway (SIPG) is used by more than 100s of Sri Lankan SME and Larger business to process their online translations safer. Sampath Bank provides these solutions for many years now. Sampath Bank promises that all communications routed through the gateway are fully protected with the uppermost international standards of security with SSL (Secure Socket Layer) 128-bit encryption certification gained from prominent Verisign Inc., USA

Setup Fee: 15,000Rs one-time payment

Recurring fee (LKR/annum): 75,000 Per Year

Transaction fee per transaction: 3% – 5%

Settlement time: Less than 48 hours

Payment options: All local and international Master or Visa Credit & Debit Cards

Onboarding & Approvals time: 1-2 week

2. Seylan Bank Payment Gateway

The Seylan Bank IPG attaches with VISA and Master for Card Payments. Gather Funds from traders and obtain card authorization from the issuing bank. As and when VISA / MASTER reconciles the money to the Bank, It will be credited to the Merchant’s Account.

Setup Fee: 20,000Rs one-time payment

Recurring fee (LKR/annum) 30,000Rs per Year

Transaction fee per transaction: 3.0% – 3.5%

Settlement time: Less than 24 hours

Payment options: Master, Visa and other cards

Onboarding & Approvals time 4 – 5 Days

3. Commercial Bank Payment Gateway

Improvements proclaimed by the Commercial Bank of Ceylon to its Internet Payment Gateway deliver new functionality for Small and Medium Enterprises (SMEs) to offer unified and safe e-Commerce and m-Commerce solutions to their customers.

Commercial Bank is the only Sri Lankan bank functioning an Internet Payment Gateway presented by MiGS (MasterCard Internet Gateway System), the Commercial Bank said the ComBank Payment Gateway (CPG) now compromises many features that help SME type transactions, without the difficulty and costs of current e-commerce structures.

Setup Fee: 10,000Rs one-time payment

Recurring fee: (LKR/annum) 48,000Rs per Annum

Transaction fee per transaction: 3%

Settlement time: Less than 48 hours

Payment options: All major credit and debit cards.

Onboarding & Approvals time: 1 Week

4. HNB Payment Gateway

HNB provides to Reveal the possible of your business with the HNB Internet Payment Gateway, fuelled by state-of-the-art technology. HNB increase your prospects by reaching your target market with unified channels in real-time, removing several expenses. HNB payment gateway solution is geared to admit any local or international debit, credit, Visa and MasterCard payment via safer transaction channels, making your selling life easier. Repayments are provided straight away, with around-the-clock help service.

Setup Fee: 15,000Rs – 20,000Rs one-time payment

Recurring fee (LKR/annum): 60,000Rs – 108,000Rs per Year

Transaction fee per transaction: 4%

Settlement time: Less than 24 hours

Payment options: International debit, credit, Visa and MasterCard

Onboarding & Approvals time: 1 Week

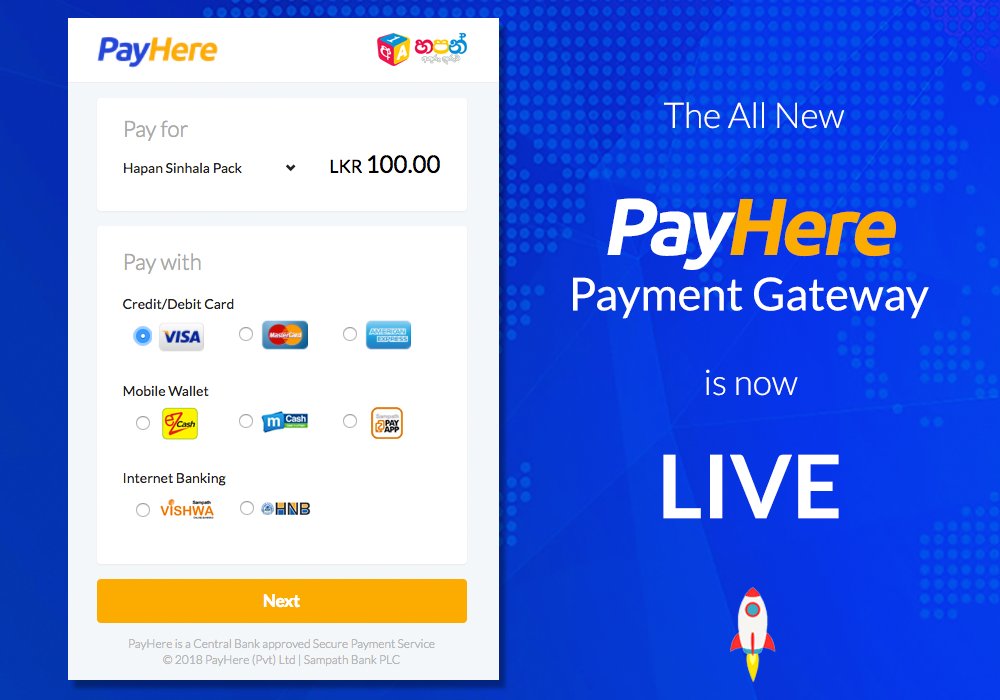

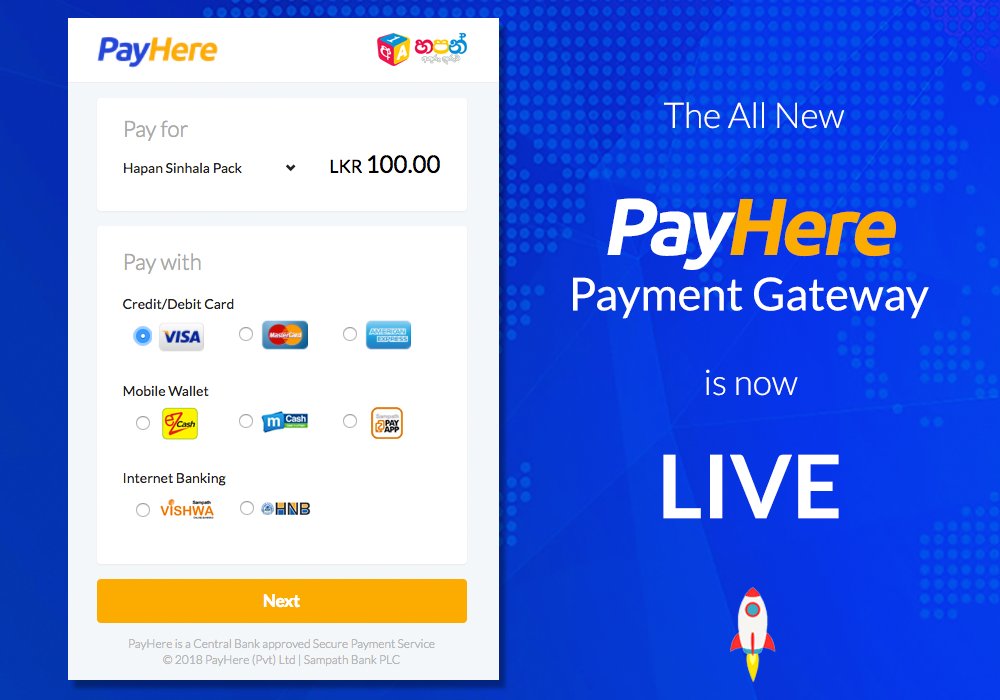

5. PayHere Payment Gateway

PayHere is considered as Sri Lanka’s first Central Bank Approved Payment Gateway. PayHere supports SMEs to accept payments online not only locally but also globally. PayHere also supports multiple currencies. However, it is a must to have a Sampath Bank Current account to get your PayHere account setup.

Setup Fee: None

Recurring fee (LKR/annum): 3.9%/transaction (basic) | 35,880 (plus) | 119,880 (premium)

Transaction fee per transaction: 3.9%, 2.99% or 2.69%

Settlement time: Less than 48 hours

Payment options: Visa, MasterCard, American Express, Discover, Diners Club, Genie, Frimi, eZcash, mCash, Sampath Vishwa

Onboarding & Approvals time: 1 Week

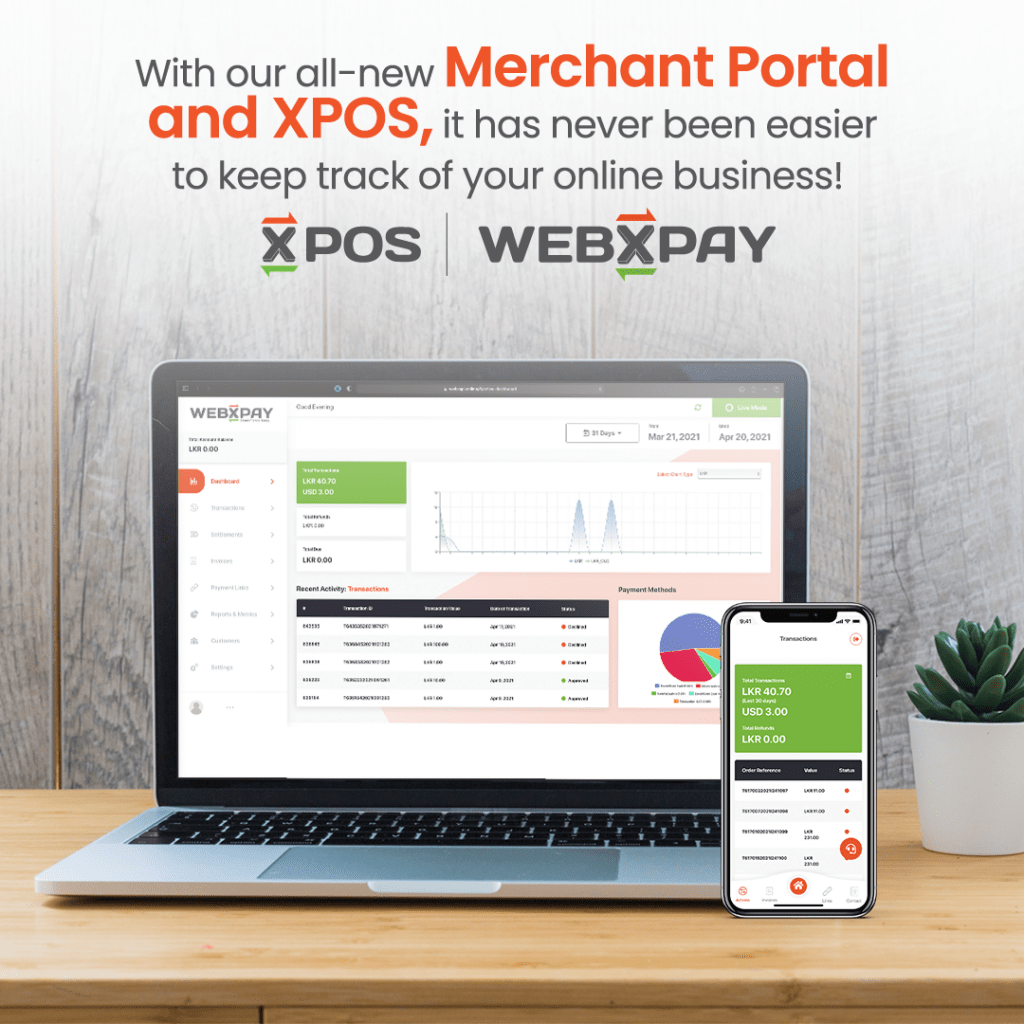

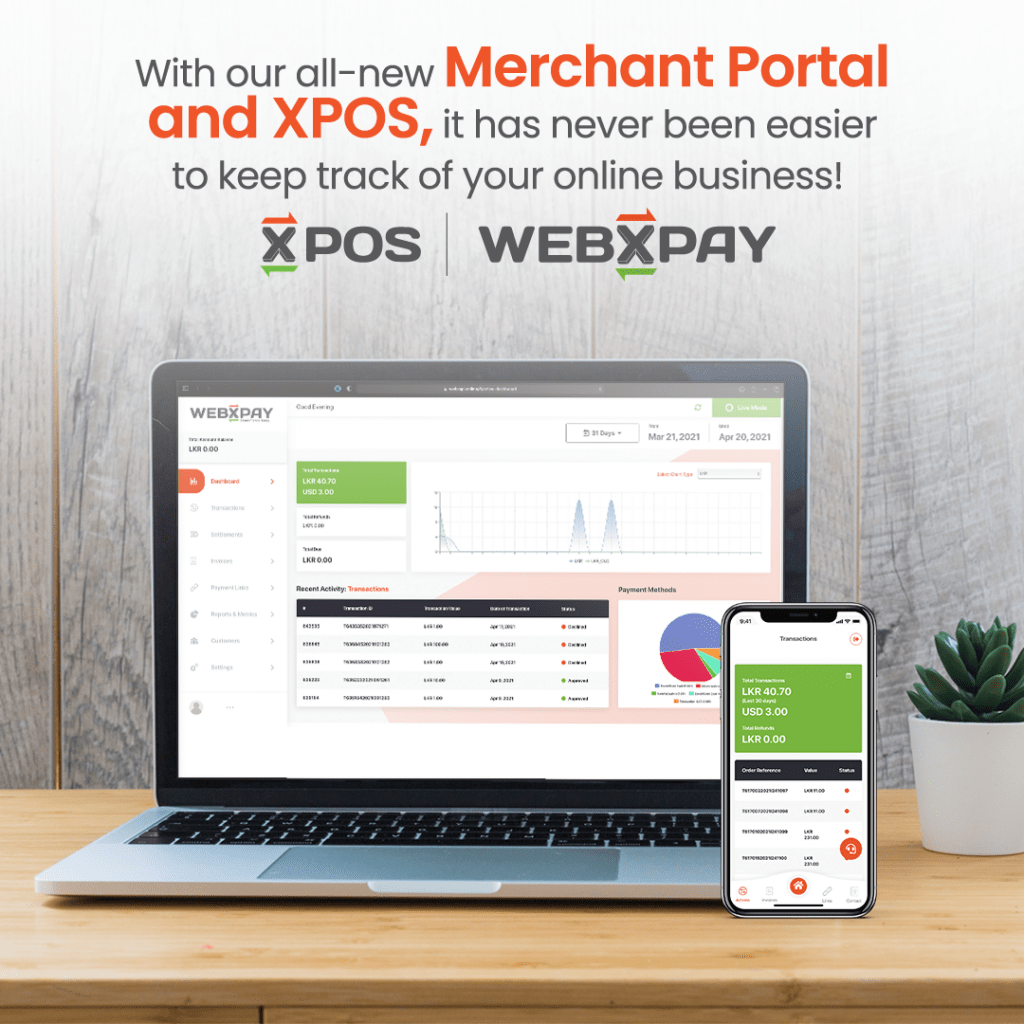

6. WEBXPAY Payment Gateway

WebXPay started serving 100 customers within the first three months. Now after 3 years, it currently services 1000+ around Sri Lanka. While comparing to any other payment gateways, WebXPay offers the most available payment options available in Sri Lanka and also considered as biggest payment gateway SaaS-based company in Sri Lanka for SMEs.

Setup Fee: No Setup Fees

Recurring fee (LKR/annum):

XGateway Enterprise – 2.3% Processing Fee and 8,990Rs Subscription Fees that is Billed Annually.

XGateway – 2.8% Processing fee and 2,490Rs Subscription Fees that is Billed Annually.

XWallet – 2.5% Processing fee and 1000Rs Subscription Fees that is Billed Annually.

Transaction fee per transaction: 2.3% – 2.8% upwards

Settlement time: Less than 48 hours

Payment options: Visa, MasterCard, China Union Pay, American Express, Discover, Diners Club, Alipay and Wechat.

Local payment brands – DFCC virtual wallet FriMi, Upay, Genie, Ezcash, Mcash, and Sampath Viswa.

EMI Payment option – Commercial Bank, American Express, DFCC, Sampath Bank And HNB.

Onboarding & Approvals time: 2 – 4 Days

7. DirectPay Payment Gateway

DirectPay offers convenient and safe internet payment gateway in Sri Lanka. DirectPay is a fintech startup which was founded in Sri Lanka back in 2017. DirectPay supports all types of banks in Sri Lanka.

Setup Fee: None

Recurring fee (LKR/annum): 36,000Rs – 60,000Rs per annum

Transaction fee per transaction: 2.6%, 2.9% and 3.5%

Settlement time: Transaction day + 2 business days (Applies to Weekdays excluding the banking holidays)

Payment options: Visa, MasterCard, American Express, Discover, Frimi

Onboarding & Approvals time: 2 – 4 Days

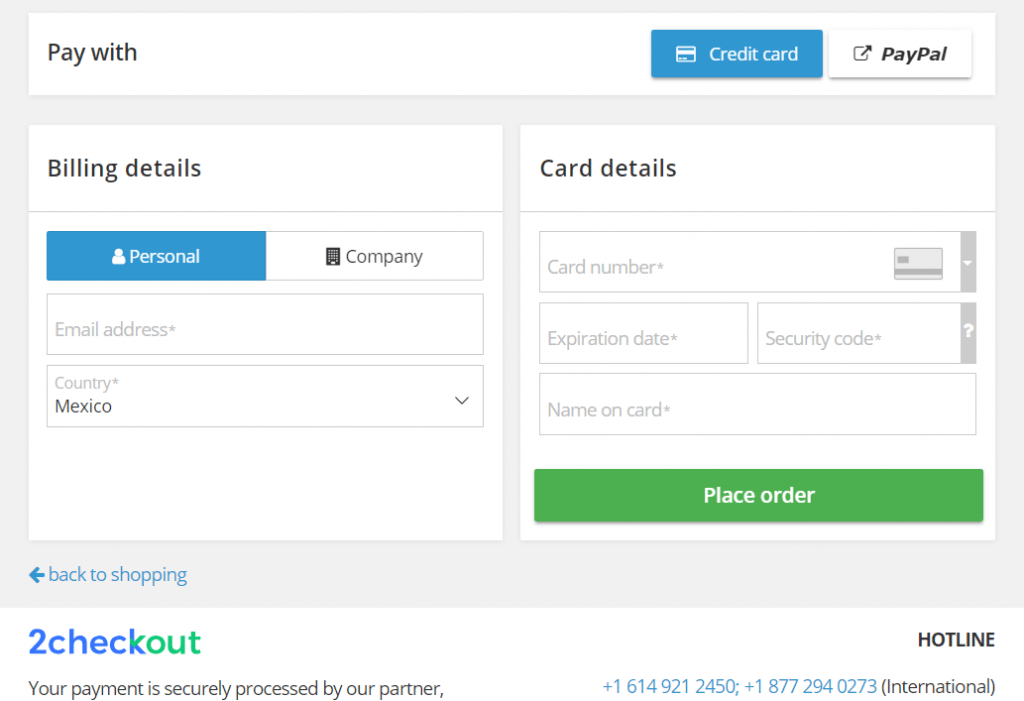

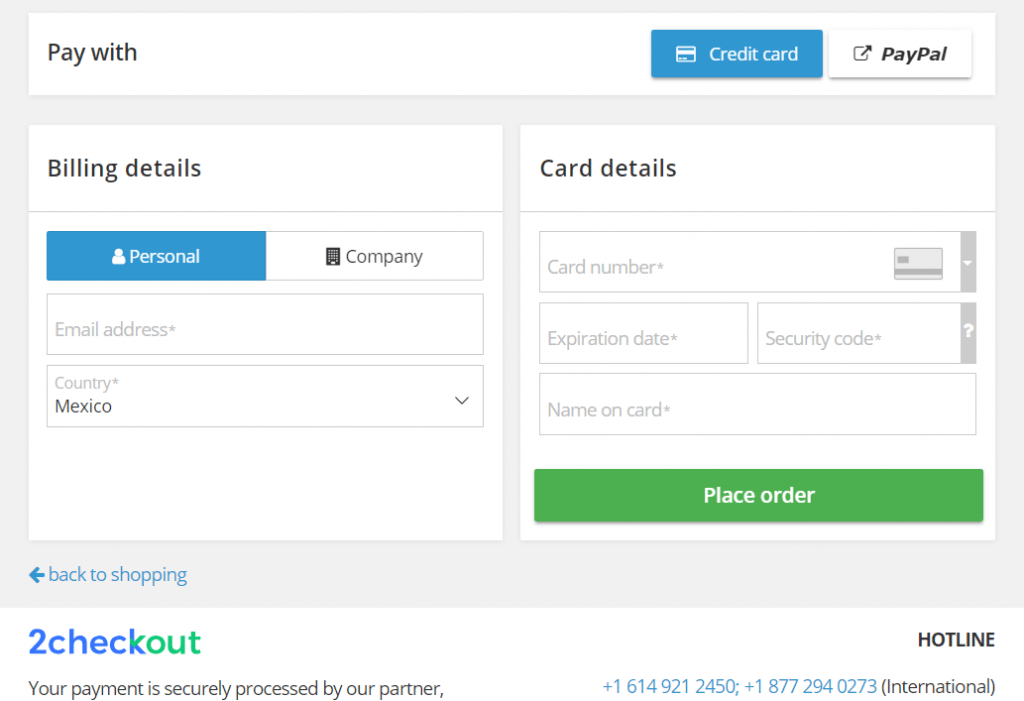

8. 2Checkout

2Checkout is the foremost all-in-one monetization podium that lets online businesses to speedily enlarge internationally and improve recurring revenue streams across channels, by streamlining the back-end difficulties that contemporary digital business creates.

Setup Fee: None

Recurring fee (LKR/annum): None (pay as you go model)

Transaction fee per transaction: 3.5% + $0.35 | 4.5% + $0.45 | 6.0% + $0.60

Settlement time: Less than 48 hours

Payment options: Almost all credit and debit cards, internet banking

Onboarding & Approvals time: 2 Days

9. Genie

Sri Lanka’s first PCI-DSS specialised payment app, Genie is a digital wallet that lets you save your Credit/ Debit cards, Current/ Savings accounts and your eZ Cash wallet in one sole app on your smart devices. eCommerce website shall connect Genie as one of the payment gateway options on their online portal.

Setup Fee: None

Recurring fee (LKR/annum): None

Transaction fee per transaction: 1.5%

Settlement time: Less than 48 hours

Payment options: Any VISA/ Mastercard -Credit/ Debit Card, Savings/Current Account, Mobile Money. Foreign cards can be linked to the genie app if the respective cardholder is a Sri Lankan citizen.

Onboarding & Approvals time: 1 Week

10. mCash

mCash lets you experience a completely new method of carrying out financial trades by keeping a Mobile Money Account. This is both useful and easy to use. You will be able to credit, withdraw, transfer funds as well as buying goods and services and even pay your utility bills. eCommerce website shall connect Genie as one of the payment gateway options on their online portal.

Setup Fee: None

Recurring fee (LKR/annum): None

Transaction fee per transaction: 1%

Settlement time: Less than 48 hours

Payment options: All major cards, internet banking, mobile SMS, wallet

Onboarding & Approvals time: 3 Days

As a result of the continuing digital disruption, eCommerce is rising rapidly in Sri Lanka and individuals are getting used to spending online. So, if you are searching for the best payment gateways in Sri Lanka for your eCommerce business, the above-mentioned list of top payment gateways in Sri Lanka in 2020 can help you with it.

Special Note – Please note the information posted here is based on what we found on the Internet. We recommend you to directly contact the payment gateways in Sri Lanka to get better commission rate before finalising.

Editorial Staff at Tectera are experts on web design, SEO, social media and other digital marketing channels.